SAP FICO | Foreign Exchange and Currency Translation I |

Handling foreign exchange (FX) and currency translation in SAP FICO can be challenging, particularly for companies operating across multiple currencies. Issues like incorrect exchange rate calculations, discrepancies in currency translations, and errors in foreign currency valuation often arise. In this blog, we’ll discuss common foreign exchange and currency translation issues in SAP FICO and provide solutions in a question-and-answer format.

1. Why are exchange rates not automatically updating in SAP?

SAP may not update exchange rates automatically if the system isn’t configured to pull rates from external sources, or if exchange rates aren’t entered manually on a regular basis.

Solution:

- Manual Entry of Exchange Rates: You can manually maintain exchange rates using T-code OB08. Ensure that all required currencies have up-to-date exchange rates.

- Set Up External Rate Feeds: For automatic exchange rate updates, set up a connection to an external service provider (e.g., Reuters, Bloomberg) via interfaces or APIs. In some cases, this setup may require development by SAP consultants or third-party tools.

- Schedule Regular Updates: To avoid outdated rates, schedule jobs in T-code SM36 to upload exchange rates periodically. This ensures the system always reflects the latest rates.

2. Why is my foreign currency valuation producing incorrect results?

Foreign currency valuations can yield incorrect results due to outdated exchange rates, incorrect valuation areas, or misconfigurations in the valuation methods.

Solution:

- Ensure Exchange Rates are Current: Use T-code OB08 to check if the correct exchange rates are maintained for the valuation date. Outdated exchange rates will lead to incorrect results.

- Check Valuation Area Settings: In T-code OB22, ensure that the correct valuation area is selected for your company code. This controls which exchange rate is used for valuation.

- Review Valuation Method: Use T-code OB59 to verify the valuation method and key date used for foreign currency valuation. Ensure that the correct valuation approach (e.g., lower of cost or market) is applied as per your accounting policies.

3. Why is there a currency difference in open item clearing?

Currency differences may appear during open item clearing if the exchange rate used for clearing differs from the exchange rate at the time of posting.

Solution:

- Clear Open Items with Correct Exchange Rate: Use T-code F.13 to clear open items and specify the correct exchange rate for the clearing process. The system will automatically post the exchange rate difference to the appropriate gain/loss accounts.

- Post Exchange Rate Difference Manually: If required, manually post any exchange rate differences using T-code FBB1 (Post Foreign Currency Valuation).

- Review Exchange Rate Differences GL Accounts: Ensure that the gain/loss accounts for exchange rate differences are properly set up in T-code OB09 to reflect currency differences in financial reporting.

4. Why does the system throw an error for missing currency translation accounts?

The system may generate an error during currency translation if the accounts for foreign exchange gains or losses are not properly assigned.

Solution:

- Assign FX Gain/Loss Accounts: Go to T-code OB09 and ensure that the GL accounts for foreign exchange gains and losses are properly assigned to your company code. Without this, the system won’t know where to post the exchange rate differences.

- Check the Account Determination in Document Types: Verify in OBA7 that the correct document types (e.g., for vendor/customer invoices, payments) have the FX gain/loss accounts assigned.

5. Why are my balance sheet accounts not translating correctly in group currency?

Balance sheet accounts may not translate correctly into the group currency due to issues in the currency translation configuration or incorrect exchange rate types.

Solution:

- Check Currency Translation Settings: Use T-code OB22 to ensure the correct translation method is applied for balance sheet accounts. Typically, balance sheet accounts should be translated using the closing exchange rate.

- Verify Group Currency Settings: In T-code OB22, review the group currency configuration. Make sure that the system is correctly converting local currency balances into the group currency as required.

- Update Exchange Rate Types: Check that the correct exchange rate type (e.g., closing rate) is selected for the translation process. This can be maintained in OBBS.

6. Why are exchange rate differences not posting during month-end foreign currency revaluation?

Exchange rate differences may fail to post during foreign currency revaluation if the valuation program is not executed properly or if GL accounts for exchange rate differences are not configured.

Solution:

- Execute Foreign Currency Revaluation: Use T-code FAGL_FC_VAL or F.05 to execute the month-end foreign currency revaluation. Make sure you select the correct valuation key date and parameters.

- Ensure GL Account Assignment for FX Differences: In T-code OB09, verify that exchange rate difference accounts are assigned to the correct chart of accounts. Both realized and unrealized FX gains and losses should have proper accounts configured.

- Review Posting Settings: Ensure that the system is set to post both realized and unrealized exchange rate differences. In some cases, the system may be configured only to post realized gains or losses, missing out on unrealized differences.

7. Why is the system calculating foreign exchange differences inconsistently?

Inconsistent calculation of FX differences may result from varying exchange rate types (e.g., buying, selling, or average rates) being used for different transactions or inconsistencies in currency translation methods.

Solution:

- Check Exchange Rate Types: Go to T-code OB08 and review the exchange rate types for your company. Different exchange rate types (e.g., M for average rate, G for group rate) can yield different results, so ensure consistency.

- Maintain Consistent Translation Methods: In T-code OB22, ensure that the same method of translation is applied across all relevant GL accounts. Use the same exchange rate type for both income statement and balance sheet translations to avoid inconsistencies.

- Review Period Closing Procedures: During period closing, use T-code F.05 to revalue foreign currency balances and ensure the correct rates are applied uniformly across transactions.

8. Why are currency differences not reflected in profit and loss accounts?

Currency differences may not reflect in the profit and loss (P&L) accounts if the FX accounts for currency gains or losses are not properly mapped in the system or if the postings are incomplete.

Solution:

- Check P&L Account Settings: Ensure that the foreign exchange gain and loss accounts are correctly mapped in T-code OB09. These should be mapped to profit and loss accounts so that currency differences flow into financial statements.

- Run Revaluation for FX Differences: Use T-code F.05 to ensure that all relevant transactions are revalued. Verify that currency differences are posted to the correct P&L accounts during this process.

- Manual Adjustment if Needed: If automatic postings do not occur, you can manually adjust currency differences using T-code FBB1.

9. Why are exchange rate gains and losses not showing correctly in my reports?

Exchange rate gains and losses may not appear correctly in financial reports due to misconfigured reporting settings, incomplete postings, or incorrect assignment of GL accounts.

Solution:

- Review Financial Reporting Configuration: Use T-code FAGLB03 (Display GL Account Balance) to check if FX gains and losses are posted to the correct GL accounts. Ensure that these accounts are included in financial reports such as profit and loss statements.

- Check the Gain/Loss Accounts Assignment: In T-code OB09, ensure that the system is posting exchange rate differences to the correct GL accounts.

- Run Currency Revaluation: If revaluation has not been performed, execute it via T-code F.05. This process will recalculate FX gains and losses and post the adjustments to the financial reports.

10. Why do I receive an error when trying to perform currency translation in CO (Controlling)?

Currency translation errors in CO often occur if the controlling area settings for currency types are incorrect or if there are issues with currency exchange rate assignments.

Solution:

- Check Controlling Area Currency Settings: Use T-code OKKP to review the controlling area currency settings. Ensure that the local currency and object currency are properly defined for cost centers and internal orders.

- Review Exchange Rate Assignments: Go to T-code OB08 and ensure that exchange rates for the controlling currency are up to date and maintained. Inconsistent or missing exchange rates can cause errors during translation.

- Validate Translation Methods: In T-code SPRO, review the currency translation settings for CO. Ensure that the correct method is applied for translating actual and planned data in the controlling area.

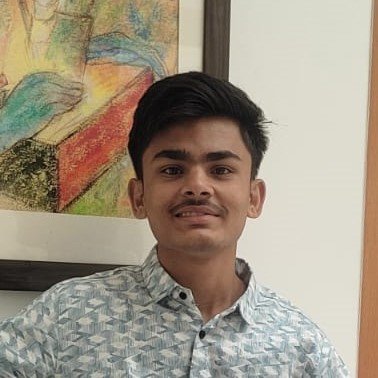

About Author

Ojas Bonde is a leading SAP FICO Consultant based in Pune, India. With a strong foundation in commerce, he has developed a deep expertise in SAP FICO over the years. Ojas specializes in helping organizations streamline their financial processes by setting up and configuring SAP systems tailored to their specific needs. His extensive knowledge allows him to effectively align complex financial concepts with the software’s functionalities, ensuring that businesses can maximize their use of SAP FICO for accurate financial reporting, compliance, and overall operational efficiency. In addition to his technical skills, Ojas is known for providing comprehensive support and troubleshooting systems.